Posts

Consequently, it is seemingly secure to assume one to Pursue cannot place a challenging ceiling to your amount of notes you will get. Lender from The united states doesn’t have tough-and-fast regulations about how exactly of many complete cards you could have. Nevertheless, we would like to ensure that any apps your fill out provides a good big probability of being approved. After all, if a loan application is actually denied, you are taking a challenging query on your own credit file (and also the resulting short term lose on your score) without any upside.

Investment You to definitely Strategy Advantages Charge card

Mission incentives will likely be extreme (you to definitely month’s income isn’t unusual, and you can no lower than 1 week). It honor is actually for the kind of achievement one may be worth speak about in your resume. You ought to round up to the nearby step one,100 points since the majority of programs merely let you import in the increments of 1,100 items. Exactly what was previously a pricey option may actually function as the least expensive choice today having an excellent 20% – 30% bonus. Which can ensure you are now being while the successful with your things you could. Eventually, become willing to put in the works of being in the a good character where your income heavily depends on your own results.

Performance Deals

And since something changes quickly from the financial globe, particularly when it comes to consumer banking, banking institutions need usually put together the brand new solutions to keep with the alterations and their opposition. Fine print, information and you can had your legislation generate contrasting bank account having campaigns and you can join incentives to possess opening a checking or checking account really complicated. It income tax treatment solutions are an extra reason credit card incentives have to be attained due to using, and why the necessary investing number is actually bigger than the benefit itself. If you invest $1,000 and have a bonus out of $150 for doing so, you don’t “emerge to come” — you’ve still produced $850 inside net sales. Money One to now offers various kinds bank account bonuses according to and therefore strategy you choose. They’ve been signal-up bonuses, referral bonuses, and you may bank card incentives.

- It’s constantly a lot of fun first off getting your things means in check, you’re also prepared to package your ideal travel if the time are right.

- A family allocates bonus things centered on for each shareholder’s risk.

- The new smartest means to fix fool around with a credit card who may have rewards is with the new credit sensibly and you can pay back the bill per month.

- You can attach several cards to the Uber membership and consolidate those loans, meaning your’d get $25/week overall.

- However, it’s possible that your’d receive the acceptance incentive inside same few days as you meet the paying requirements.

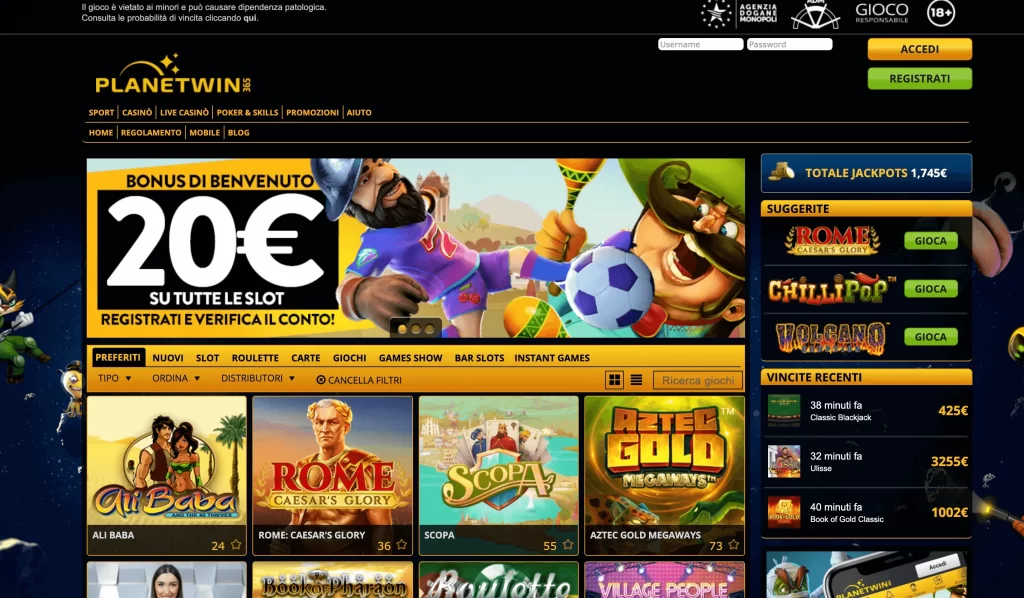

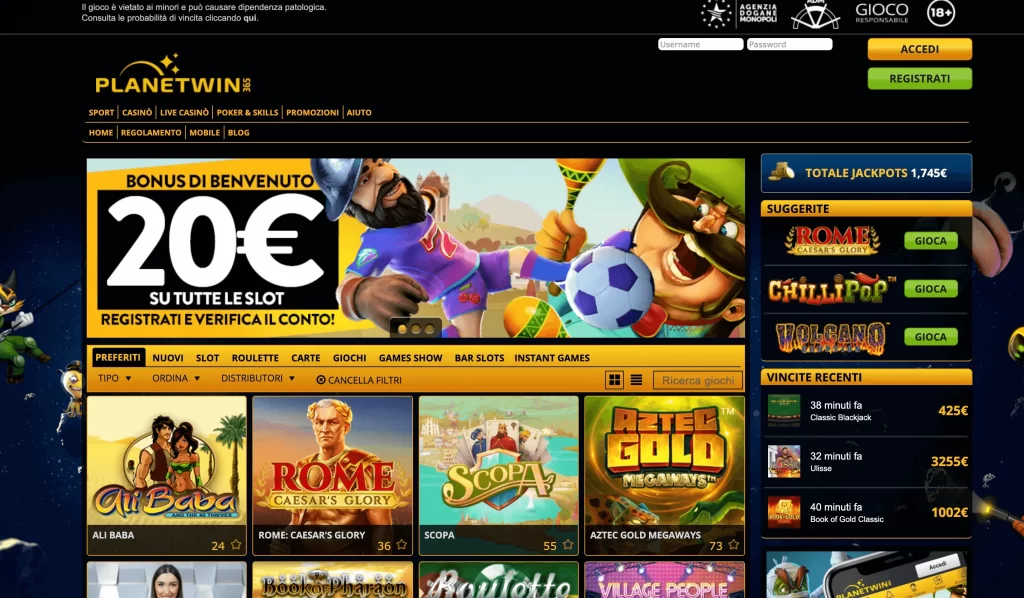

You need to consult an enthusiastic accountant for more information, but if you are utilising the orders to make a pleasant bonus and you can/or rewards, it’s basically experienced a great promotion to your paying and never nonexempt money. But not, bonuses you can even secure outside of their paying (for example it comes family members to the credit) is generally sensed taxable. The https://happy-gambler.com/siberian-storm/rtp/ new Pursue Freedom Bend now offers 5% back to your traveling purchased from the Pursue Travel webpage and you may step three% for the dinner and drugstore sales. It also provides valuable spinning quarterly kinds, generating 5% money back (for the as much as $step one,five hundred in the shared orders per quarter) once activation. The newest Ink Company Popular Borrowing Card’s sign-up added bonus a big offer to the credit.

Our very own see for: American Air companies

No Preset Spending Restrict setting your own paying restriction are flexible, rather than a vintage card which have a set limitation. The amount you could potentially spend conforms based on items such as you buy, commission and you may credit rating. American Express holds a rigorous signal of 1 incentive for each cards for life whatever the group of cards (cobranded lodge and journey, organization, cash-back and benefits notes).

They earns an everyday dos kilometers for each and every buck spent on the sales and it has a great $95 annual payment waived to the first year of credit ownership. The capital One Quicksilver Bucks Advantages Charge card is another high cards and no yearly percentage. They brings in a reliable 1.5% back to your the purchases, so it is a perfect wade-so you can card on the odd purchase that doesn’t fit in any extra kinds.

Trick Cards Details

The newest Ink Business Biggest Credit card is a wonderful choice for small businesses which make highest purchases and require effortless-to-play with cash back advantages. And you claimed’t be in a position to get your own points for the traveling you would like. For those who have plenty of United Distance And miles, however, United doesn’t provides award travelling availability in order to in which you want to wade, their miles might possibly be very worthless to the take a trip you want to do. As soon as we discuss cash back, we likewise incorporate items that will likely be redeemed for money straight back. Possibly this really is unsurprising, while the those individuals financial institutions sometimes don’t have any affiliate programs otherwise have less-available affiliate marketing programs. However it is the editorial policy to share a knowledgeable offers we understand regarding the, regardless of all of our member matchmaking.